The Death of the Department Store: ‘Very Few Are Likely to Survive’

THE DEATH OF THE DEPARTMENT STORE: ‘Very Few Are Likely To Survive’

Neiman Marcus has stopped accepting new merchandise.

Credit…Karsten Moran for The New York Times

Retailers have begun taking extreme measures to try to survive.

Le Tote, a subscription clothing company that acquired Lord & Taylor from Hudson’s Bay, let go of its entire executive team, including the chief executive. They also suspended payments of goods to vendors for at least 90 days, citing “immense pressure on our liquidity position.”Macy’s, which also owns Bloomingdale’s, extended payment for goods and services to 120 days from 60 days and, according to Reuters, has hired bankers from Lazard to explore new financing. Jeff Gennette, the chief executive, is forgoing any compensation for the duration of the crisis. The company was dropped from the S&P 500 last month based on its valuation. J.C. Penney has hired Lazard, the law firm Kirkland & Ellis and the consultancy AlixPartners to explore restructuring options, according to two people familiar with the matter, and confirmed that it skipped an interest payment on its debt last week. It is expected to make a decision on what to do, including potentially filing for bankruptcy, within a few weeks, one of the people said.

Related Articles: How Covid-19 Changed the Resale MarketRelated Articles: J.Crew Prepares to File for Bankruptcy

But none of them were in as immediate dire straits as Neiman Marcus, which has both an enormous debt burden — about $4.8 billion, thanks in part to a leveraged buyout in 2013 by the owners Ares Management and the Canada Pension Plan Investment Board — and a raft of expensive rents in the most high-profile shopping destinations, signed during boom times.In late March, Neiman stopped accepting new merchandise and furloughed a large portion of its approximately 14,000 employees as the rumors of bankruptcy began to swirl. Its chief executive, Geoffroy van Raemdonck, announced that he was waiving his salary for April. The brand denied to vendors and its own employees at its sister brand Bergdorf Goodman that it was engaging advisers to explore a bankruptcy filing, but on April 14, S&P downgraded Neiman’s credit rating. Last week, the retailer did not make an interest payment that was due on April 15, angering bondholders and further fueling suspicions that a bankruptcy filing was imminent. A spokesperson for Neiman Marcus declined to comment.

Barneys offered steep discounts after declaring bankruptcy last year.Credit…Stephen Speranza for The New York Times

Even Nordstrom, widely considered the healthiest department store, said this month that it could be facing a “distressed” situation if its physical locations closed to customers for “an extended period of time.” Erik and Pete Nordstrom, chief executive and chief brand officer, are both receiving no base salary for at least six months. The chain has stunned some vendors with last-minute cancellations via email in recent days.

Across chains, prices for new merchandise sold via e-commerce have already been slashed by 40 percent in some cases. Order cancellations for the pre-fall season — which would normally have started delivering next month — have been increasing. Some brands said shipments have even been turned away upon delivery to warehouses, and extensions of payment terms are cascading through vendors, who are then forced to negotiate with their own manufacturers, marketing agencies, fulfillment centers and landlords.“I’ve had a showroom for over 30 years, and we have always used the word ‘partnership,’ when talking about our relationship with the department stores,” said Betsee Isenberg of the showroom 10Eleven, which represents numerous brands such as Vince and ATM. “Through 9/11, through 2008, we worked hand in hand with our retailers. This is the first time the onus has been on the brands — many of which are losing millions and millions of dollars because of the canceled orders. It is just not fair that it is survival of the fittest.” In a new report, McKinsey refers to the situation as “wholesale Darwinism.”The resort season has been canceled entirely, and fall orders have been put on hold, raising questions about what inventory will be left if and when shops reopen and consumers return to store.

The Neiman Marcus store at Hudson Yards in Manhattan. With stores closed, retailers have seen sales plummet.Credit…Mark Wickens for The New York Times

“Nobody knows what Q4 will be like, but you have to start putting the orders in now,” Sucharita Kodali, a retail analyst at Forrester, said of the holiday season, normally the most lucrative time of the year for the chains. “Some people don’t even have the money to put in Q4 orders, and may have to cancel Q4 orders anyway, and it’s a mess. There’s never been this much uncertainty.”Robert Burke, the eponymous founder of a luxury consultancy, said he expected brands to move further away from a wholesale business, focusing on direct-to-consumer and a model with department stores where they control their own space and inventory.Shares of J.C. Penney, which has temporarily shut its more than 800 stores, closed at 23 cents on the dollar last Wednesday after the retailer said it did not make a $12 million interest payment due that day. Brooke Buchanan, a representative, said it was a “strategic decision” in order to take advantage of a 30-day grace period before it was considered in default.

Normally bustling stores like Saks Fifth Avenue are now empty.Credit…Haruka Sakaguchi for The New York Times

Ms. Buchanan said J.C. Penney had “been engaged in discussions with its lenders since mid-2019 to evaluate options to strengthen its balance sheet, a process that has become even more important as our stores have also closed due to the pandemic.”Cash flow for all department stores has dropped sharply. In a note on April 13, analysts at Cowen estimated four months of liquidity at Macy’s, six months at Kohl’s and seven months for J.C. Penney. Nordstrom, they predicted, could withstand store closings for 12 months.“The nature of the mall is if you lose a big anchor like a Macy’s, you have co-tenancy issues and you have more pressure on the mall traffic, which was already a big issue,” said Oliver Chen, an analyst at Cowen. Co-tenancy clauses typically allow other tenants to demand rent reductions if certain key chains depart. Mr. Chen said that could accelerate the ongoing divide between top-tier malls and the second- or third-choice malls in certain areas. According to a report this month from S&P Global Market Intelligence, department stores were more likely than any other consumer industry to default on their debt in the next year. It estimated the probability at 42 percent.

Nordstrom’s new store in Manhattan. Analysts predicted that it had enough cash to withstand 12 months of stores closures.Credit…Karsten Moran for The New York Times

In its April 2 memo, the management of Le Tote and Lord & Taylor said only “key employees” were being retained to preserve the business. A representative for Lord & Taylor and Le Tote declined to comment or disclose the number of employees who were furloughed and laid off.“It appears to be a virtual certainty that Lord & Taylor will liquidate its business in the near future, either in or out of bankruptcy,” said James Van Horn, a partner at Barnes & Thornburg and a specialist in retail bankruptcy. “They were already one of the most challenged department stores prior to the coronavirus pandemic, and when the majority of the management team is leaving, the vast majority of employees are laid off and a minority of employees furloughed, there does not seem to be any other strategy but to liquidate the inventory.”Mr. Van Horn said he expected that other chains might strategically employ Chapter 11 reorganizations to legally shed stores, lightening their rent burden.“It will likely be a domino that falls,” he said. “Whether it is first or 10th, we don’t know.”

Read the full original article here.

Disclaimer: Real Authentication is a 3rd party authentication service and is in no way affiliated with the brands it services.

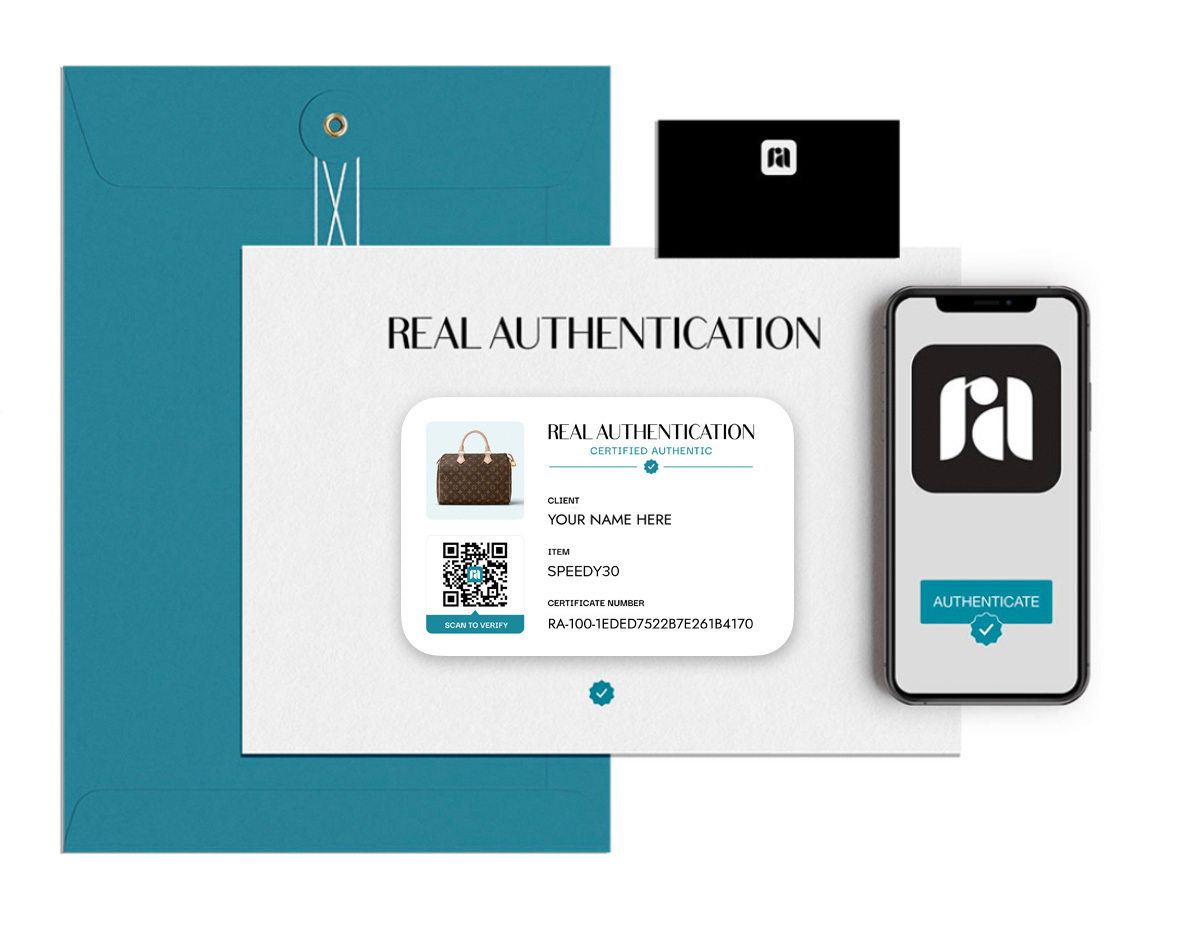

About Real Authentication: Real Authentication’s mission is to provide individuals, dealers, and global brands with unparalleled confidence and peace of mind by leveraging our deep expertise and years of experience to deliver the most trusted and accurate luxury goods authentication service available. Follow this blog and sign up for our newsletter using the form below for more industry news, tips to spot counterfeits, and more! You can also connect with us on social media on Facebook, Instagram, TikTok, and Pinterest.

Need Expert Authentication?

Our user-friendly process lets you receive authentication in as little as 1 hour from anywhere in the world.

1. Upload Your Photos

Simply upload images showing your product—anything from luxury handbags to clothing, shoes, and more.

2. Product is Verified

Two or more expert luxury authenticators typically review each product. Orders stay in your account for future reference. Added layers of AI technology and Quality assurance help to ensure accuracy prior to approval.

3. Get Certification

Instantly receive electronic certification. Upgrade your order at any time to receive official documentation—from Authenticity Cards to Written Statements.